reverse sales tax calculator nj

75100 0075 tax rate as a decimal. Tax 104993 tax value rouded to 2 decimals.

Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price.

. New Jersey Sales Tax. Amount without sales tax QST rate QST amount. This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions.

To easily divide by 100 just move the decimal point two spaces to the left. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Jersey local counties cities and special taxation districts. New Jersey Sales Tax Calculator calculates the sales tax and final price for any New Jersey.

Related

New Jersey has a 6625 statewide sales tax rate but also has 312 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0003 on top of the state tax. Simply enter the costprice and the sales tax percentage and the NJ sales tax calculator will calculate the tax and the final price. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Sales Tax Amount Net Price x Sales Tax Percentage 100 Total Price Net Price Sales Tax Amount. Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663. Formulas to Calculate Reverse Sales Tax.

Not all products are taxed at the same rate or even taxed at all in a given. New Jersey has a single statewide sales tax rate. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This script calculates the Before Tax Price and the Tax Value being charged. Input the Tax Rate. We can not guarantee its accuracy.

Reverse Sales Tax Calculator Remove Tax. Please check the value of Sales Tax in other sources to ensure that it is the correct value. Here is how the total is calculated before sales tax.

The harmonized sales tax or hst is a sales tax that is applied to most goods and services in a number of canadian provinces. The NJ sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price. Often knowing the post-tax price in one municipality will provide little.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Sales and Use Tax.

How to Calculate Reverse Sales Tax. To find the original price of an item you need this formula. Find your New Jersey combined state and local tax rate.

The base state sales tax rate in New Jersey is 6625. Firstly divide the tax rate by 100. The flat sales tax rate means you will pay the same rate wherever you are in the state with two exceptions.

Us Sales Tax Calculator Reverse Sales Dremployee A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. Please note state sales.

Amount without sales tax GST rate GST amount. Sales tax rates can change over timethe calculator provides estimates based on current available rates. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

There are times when you may want to find out the original price of the items youve purchased before tax. New Jersey sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. That entry would be 0775 for the percentage.

If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and the amount of sales tax that was in the total price. I have included the following reverse sales tax calculator for calculating the before-tax price and sales tax amount from the final amount paid. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law.

Now find the tax value by multiplying tax rate by the before tax price. Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. Check out flexible QuickBooks sales tax software for your business to track sales sales tax and cash flow.

Following is the reverse sales tax formula on how to calculate reverse tax. Videos you watch may be added to the TVs watch history and influence TV. Instead of using the reverse sales tax calculator you can compute this manually.

OP with sales tax OP tax rate in decimal form 1. With QuickBooks sales tax rates are calculated automatically for each transaction saving you time so you can focus on your business. PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes.

Input the Final Price Including Tax price plus tax added on. The second script is the reverse of the first. Tax 13999 0075.

New Mexico NM 5125. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

1 2018 that rate decreased from 6875 to 6625. If playback doesnt begin shortly try restarting your device. This is particularly useful if you sell merchandise on a tax included basis and then must determine how much.

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calculator Academy

With New Taxes Considered New Jersey Faltering In Key Economic Areas Njbia

Reverse Sales Tax Calculator Calculator Academy

Us Sales Tax Calculator Reverse Sales Dremployee

Calculator With Sales Tax Top Sellers 58 Off Www Pegasusaerogroup Com

Calculator With Sales Tax Top Sellers 58 Off Www Pegasusaerogroup Com

Collecting Nj Sales Tax As A Photographer Lin Pernille

Sales Tax Recovery Reverse Sales Tax Audit Pmba

How To Calculate Sales Tax Backwards From Total

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

New Jersey Sales Tax Calculator Reverse Sales Dremployee

Us Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator 100 Free Calculators Io

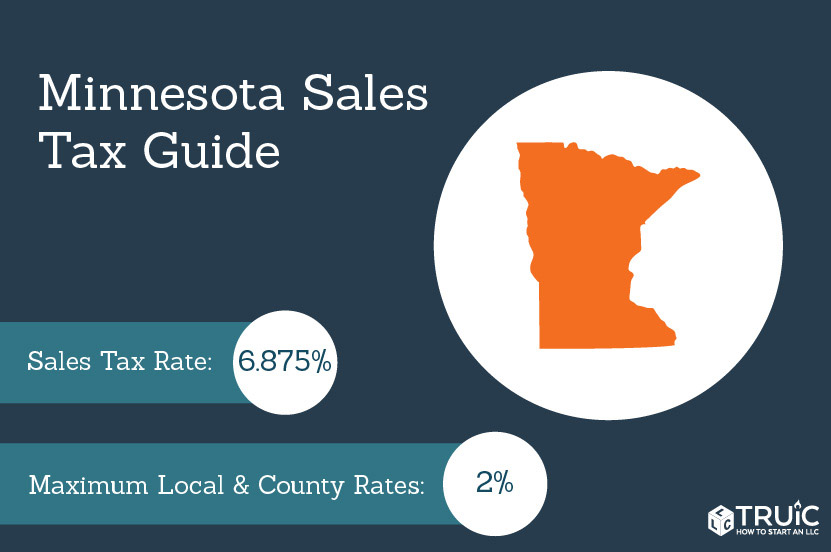

Minnesota Sales Tax Small Business Guide Truic

Reverse Sales Tax Calculator De Calculator Accounting Portal